Forget Normcore: Birkenstock CEO Says People “Just Want to Get Real” – Sourcing Journal

Germany

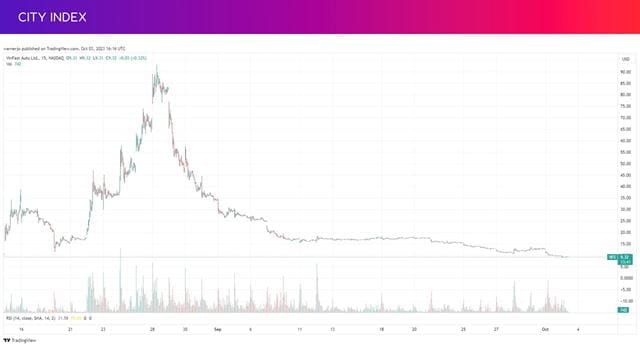

IPO stocks outlook: Arm, Instacart, VinFast, Klaviyo & Birkenstock

List of top Restaurants Acquired Companies With More Than $1M in Revenue - Recent News & Activity

Birkenstock Prices IPO Within Range at $46 a Share

Hopes rise for IPO recovery after September deal rush - The Globe and Mail

The Birkenstock IPO Is Coming. Nobody Mention Crocs. - WSJ

Borneo Bulletin Online, The Independent Newspaper in Brunei Darussalam, Sabah and Sarawak

Birkenstock plans for New York IPO with valuation of up to $9.2bn

Stock Sharks 📈🦈 on Instagram: Birkenstock, the German premium footwear brand backed by private-equity firm L Catterton, said on Monday it is seeking a valuation of up to $9.2 billion in its

Klaviyo Shares Soar in Debut, Pointing to IPO Resurgence - WSJ

US new auto sales likely rose in Q3, but UAW strikes may pose speed bump

How Birkenstock's lackluster debut mistimed the shaky IPO market - Essentials